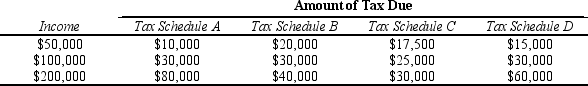

Table 12-11

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-11.For an individual with $200,000 in taxable income,which tax schedule has the highest average tax rate?

Definitions:

Q8: If we want to gauge the sacrifice

Q59: David's firm experiences diminishing marginal product for

Q68: Refer to Table 12-14.Which tax schedules are

Q70: Refer to Table 13-11.What is variable cost

Q121: When an infinite value is placed on

Q154: The average tax rate measures the<br>A) fraction

Q193: Which tax system requires higher-income taxpayers to

Q226: The administrative burden of complying with tax

Q309: Refer to Table 13-4.Each worker at Gallo's

Q403: The firm's efficient scale is the quantity