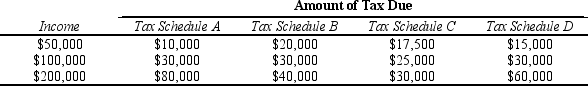

Table 12-14

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-14.Which tax schedules are progressive?

Definitions:

Ethical

Pertaining to or dealing with morals or the principles of morality; pertaining to right and wrong in conduct.

Self-Serving Bias

The common tendency to attribute one's successes to personal factors and one's failures to external factors.

Unrealistically High

Describes expectations or standards that are excessively beyond what is achievable or reasonable.

Aggressively

In a manner that is forceful, energetic, or determined, often aiming to dominate or assert oneself.

Q40: Refer to Figure 13-4.Curve D represents which

Q59: David's firm experiences diminishing marginal product for

Q183: Which of the following statements about state

Q211: Refer to Table 12-2.If John has taxable

Q212: Refer to Figure 13-5.Why doesn't the total

Q258: Refer to Table 13-12.Which firm is experiencing

Q289: Refer to Table 12-2.If John has taxable

Q349: Who pays a corporate income tax?<br>A) Owners

Q377: Because taxes distort incentives,they typically result in<br>A)

Q420: Refer to Table 13-5.What is the value