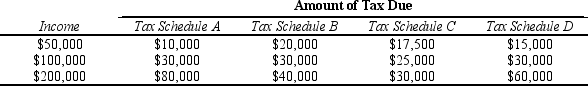

Table 12-14

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.

-Refer to Table 12-14.Which tax schedules are regressive?

Definitions:

Temporal Discounting

A preference for immediate gratification over rewards that come later.

Risk Aversion

A behavioral tendency to prefer avoiding losses over acquiring equivalent gains, indicating a preference for certainty and safety.

Certainty Effect

The tendency for people to give greater weight to outcomes that are certain, compared to outcomes that are probable, often observed in decision-making under uncertainty.

Definite Outcomes

A term used to describe results or consequences that are clear, predictable, and unambiguous.

Q74: In the long run Firm A incurs

Q104: Refer to Table 12-1.If Barb has $126,000

Q140: A tax on gasoline often reduces road

Q173: Economies of scale arise when<br>A) an economy

Q219: Lump-sum taxes are equitable but not efficient.

Q289: Refer to Table 12-2.If John has taxable

Q325: Refer to Scenario 13-5.According to Samantha's accountant,which

Q378: Refer to Table 13-12.Which firm is experiencing

Q385: Tax evasion is<br>A) facilitated by legal deductions

Q418: To an economist,the field of industrial organization