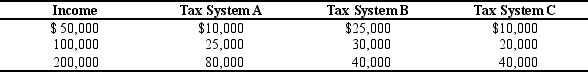

Table 12-15

The dollar amounts in the last three columns are the taxes owed under the three different tax systems.

-Refer to Table 12-15.Which of the three tax systems is progressive?

Definitions:

Obligations

Duties or responsibilities enforced by law, contract, or a sense of duty that compel someone to act or refrain from acting in a certain manner.

Disability

A physical or mental condition that significantly restricts one's ability to perform one or more major life activities.

Life Insurance

A contract between a policy owner and an insurance company that requires the insurance company to pay a designated beneficiary a sum of money upon the occurrence of the insured’s death.

Commercial General Liability

Insurance coverage that protects businesses against claims of bodily injury, property damage, and personal and advertising injury that may arise from its operations.

Q23: Accounting profit is equal to<br>A) marginal revenue

Q84: As of 2005,the largest source of receipts

Q88: The U.S.federal government collects approximately what percentage

Q183: Which of the following statements about state

Q240: Which of the following is an example

Q250: A lighthouse is typically considered to be

Q281: When an individual firm in a competitive

Q304: Horizontal equity refers to a tax system

Q306: Suppose the government imposes a tax of

Q417: Refer to Scenario 13-8.Average fixed cost will