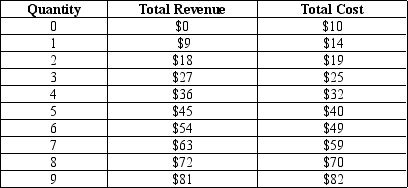

Table 14-5

-Refer to Table 14-5.The maximum profit available to this firm is

Definitions:

Progressive Tax

A tax system in which the tax rate increases as the taxable amount increases, placing a larger burden on those who have higher earnings.

Average Tax Rate

The proportion of the total taxable income paid in taxes, calculated by dividing the total tax amount by the total income.

Regressive Tax

A tax system where the tax rate decreases as the amount subject to taxation increases, often placing a heavier burden on lower-income individuals.

Higher Incomes

Levels of earnings that exceed the average or median income for a particular region or demographic.

Q17: When marginal revenue equals marginal cost,the firm<br>A)

Q43: Refer to Figure 14-2.If the market price

Q47: Deadweight loss<br>A) measures monopoly inefficiency.<br>B) exceeds monopoly

Q105: If the government regulates the price a

Q159: The analysis of competitive firms sheds light

Q248: On a 100-acre farm,a farmer is able

Q259: University financial aid can be viewed as

Q277: Which of the following statements is true

Q281: Which of the following is an example

Q370: If a pharmaceutical company discovers a new