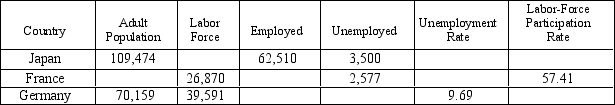

The table below uses data for the year 2003 provided by the Bureau of Labor Statistics and adjusted to be comparable to U.S.data.All values are in thousands.Fill in the blank entries in the table.

Definitions:

Excise Tax

A tax charged on specific goods and services, such as alcohol, tobacco, and gasoline, usually to discourage their use or generate revenue.

Equilibrium Price

The price in a competitive market at which the quantity demanded and the quantity supplied are equal, there is neither a shortage nor a surplus, and there is no tendency for price to rise or fall.

Federal Income Tax

Federal income tax is the tax levied by the national government on individuals and organizations' annual earnings.

Taxpayers

Individuals or entities obligated to pay taxes to governmental authorities.

Q51: Which of the following lists ranks types

Q82: The labor-force participation rate tells us the

Q106: Which of the following is the correct

Q126: You have been promised a payment of

Q231: Refer to Table 28-2.How many people were

Q263: Writing in The New York Times in

Q389: When the wage is above the equilibrium

Q432: It is only among the least skilled

Q465: Which of the following is not correct?<br>A)

Q471: Unemployment insurance reduces hardships of unemployment but