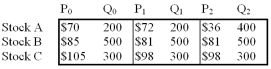

-Based on the information given,for a price-weighted index of the three stocks calculate:

a.the rate of return for the first period (t = 0 to t = 1).

b.the value of the divisor in the second period (t=2).Assume that Stock A had a 2-1 split during this period.

c.the rate of return for the second period (t = 1 to t = 2).

Definitions:

Economic Sense

The logic or rationale behind economic decisions or policies, often evaluated in terms of benefits versus costs.

Progressed

Advanced or moved forward in development or improvement.

Nations

Vast collectives of individuals linked through shared ancestry, historical background, cultural practices, or linguistic similarities, residing in a specific nation or region.

Real GDP

The calculation of a nation's economic production, corrected for changes in prices due to inflation or deflation, to accurately represent the actual worth of the produced goods and services.

Q18: For a taxpayer in the 25% marginal

Q19: The principal cause of falling unemployment is

Q19: In a factor model,the return on a

Q25: The argument that _ receives strong support

Q30: The _ gives the number of shares

Q34: The price quotations of Canada bonds show

Q51: According to the CAPM,the risk premium an

Q60: Consider the following probability distribution for

Q86: Which of the following provides support for

Q89: A coupon bond that pays interest annually