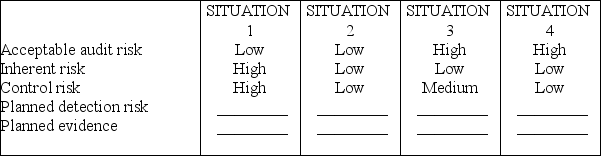

In practice,auditors rarely assign numerical probabilities to inherent risk,control risk,or acceptable audit risk.It is more common to assess these risks as high,medium,or low.For each of the four situations below,fill in the blanks for planned detection risk and the amount of evidence you would plan to gather ("planned evidence")using the terms high,medium,or low.

Definitions:

Operating Assets

Assets that are used in the day-to-day operations of a business to generate revenue, excluding investment and non-operational assets.

Controllable Margin

The portion of profit or income that can be directly controlled or influenced by management decisions.

Controllable Costs

Controllable costs are expenses that can be regulated or influenced by decisions made by managers or individuals within a company, allowing for adjustments based on operational needs.

Responsibility Accounting

A system of accounting that segments performance by areas of responsibility within the organization, allowing for better monitoring and accountability.

Q9: Internal controls can never be regarded as

Q13: Discuss the relationship of each of the

Q16: Discuss what is meant by the term

Q47: Auditors must make decisions regarding what evidence

Q53: The assessment of control risk is the

Q60: In a financial statement audit,inherent risk is

Q66: Briefly explain each management assertion related to

Q88: A bill of lading is a written

Q90: Companies with non-complex IT environments often rely

Q92: Auditors may identify conditions during fieldwork that