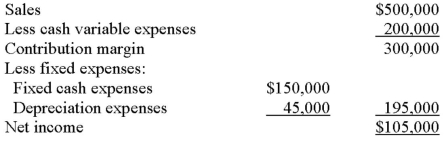

Jarvey Company is studying a project that would have a ten-year life and would require a $450,000 investment in equipment that has no salvage value.The project would provide net income each year as follows for the life of the project:  The company's required rate of return is 12%.What is the payback period for this project?

The company's required rate of return is 12%.What is the payback period for this project?

Definitions:

Performance Rating

An evaluation measure used to assess the efficiency, effectiveness, or output level of employees, processes, or equipment against predefined standards.

Observed Time

The actual amount of time recorded for a task or process operation based on direct observation.

Futures Contract

A legally binding contract for the future transaction of goods or assets at a set price and predetermined date.

Cash Flows

Cash flows represent the net amount of cash and cash-equivalents being transferred into and out of a business, crucial for assessing its financial health, liquidity, and solvency.

Q28: Lusk Company produces and sells 15,000 units

Q28: Friden Company has budgeted sales and production

Q29: In companies that have "no lay-off" policies,the

Q37: Some managers believe that residual income is

Q39: An avoidable cost is a cost that

Q72: Boston Company is contemplating the purchase of

Q73: The terms "standard quantity allowed" or "standard

Q114: The budgeted accounts receivable balance on September

Q153: Larned Company's dividend payout ratio for 20

Q176: Larned Company's dividend yield ratio on December