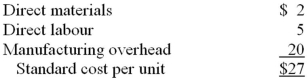

The following standard costs pertain to a component part manufactured by Ashby Company:  The company can purchase the part from an outside supplier for $25 per unit.The manufacturing overhead is 60% fixed and this fixed portion would not be affected by this decision.Assume that direct labour is an avoidable cost in this decision.What is the relevant amount of the standard cost per unit to be considered in a decision of whether to make the part internally or buy it from the external supplier?

The company can purchase the part from an outside supplier for $25 per unit.The manufacturing overhead is 60% fixed and this fixed portion would not be affected by this decision.Assume that direct labour is an avoidable cost in this decision.What is the relevant amount of the standard cost per unit to be considered in a decision of whether to make the part internally or buy it from the external supplier?

Definitions:

Straight-Line Method

A method of calculating depreciation of an asset by evenly spreading the cost over its useful life.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board (IASB) that are globally accepted.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting wear and tear, deterioration, or obsolescence.

Straight-Line Method

A depreciation technique that allocates an equal portion of the cost of an asset to each year of its useful life.

Q12: Suppose a manager's performance is to be

Q23: The material quantity variance for November was:<br>A)

Q34: The materials quantity variance for January is:<br>A)

Q37: The following data pertain to an investment

Q52: Analysing the changes from the end of

Q64: The total debits to the Manufacturing Overhead

Q91: The total of units to be produced

Q93: What is the total variable manufacturing overhead

Q105: To record the incurrence of direct labour

Q163: Tower Company planned to produce 3,000 units