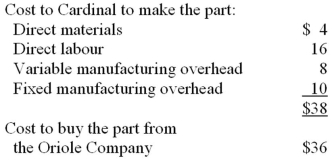

Cardinal Company needs 20,000 units of a certain part to use in one of its products.The following information is available:  Oriole Company has offered to sell this part to Cardinal company for $36 each.If Cardinal buys the part from Oriole instead of making it,Cardinal would not have any use for the released capacity.In addition,60% of the fixed manufacturing overhead costs will continue regardless of what decision is made.Assume that direct labour is an avoidable cost in this decision.In deciding whether to make or buy the part,the total relevant costs to make the part are:

Oriole Company has offered to sell this part to Cardinal company for $36 each.If Cardinal buys the part from Oriole instead of making it,Cardinal would not have any use for the released capacity.In addition,60% of the fixed manufacturing overhead costs will continue regardless of what decision is made.Assume that direct labour is an avoidable cost in this decision.In deciding whether to make or buy the part,the total relevant costs to make the part are:

Definitions:

Installation

The process of setting up and configuring hardware or software systems to make them ready for operation.

Earnings Before Taxes

An indicator of a company's financial performance calculated as revenue minus expenses, excluding taxes.

Annual Depreciation

The annual allocation of the cost of an asset over its useful life, reflecting the consumption or the decline in the value of the asset over that period.

Net Working Capital

The difference between a company's current assets and current liabilities, indicating its short-term liquidity and ability to finance day-to-day operations.

Q14: The sunk cost in this situation is:<br>A)

Q22: The expected cash disbursements during April for

Q29: Kelcom Consultancy is considering an investment that

Q31: In a make or buy decision,which of

Q36: Once the break-even point has been reached,increases

Q36: Parks Company is considering an investment proposal

Q84: Determine the total cash disbursements that Cummings

Q90: If the company has budgeted to sell

Q117: Managers will always seek to eliminate all

Q170: Calculate the return on total assets for