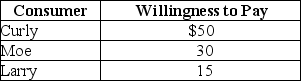

Table 4-1

-Refer to Table 4-1.The table above lists the highest prices three consumers,Curly,Moe,and Larry,are willing to pay for a bottle of champagne.If the price of the champagne falls from $24 to $14

Definitions:

Tax Effect

The impact of tax laws and regulations on an individual's or company's financial decisions and situations, including the calculation of tax liabilities.

Carrying Amount

The value at which an asset is recognized in the balance sheet after accounting for depreciation, amortization, and impairment losses.

Periodic Method

An accounting method where inventory and cost of goods sold (COGS) are determined at the end of an accounting period, as opposed to continuously tracking these figures.

Tax Rate

Represents the percentage at which an individual or corporation is taxed, often varying based on income level, type of income, or jurisdiction.

Q83: If Abigail can make more candles in

Q127: In 2016,infant mortality in the United States

Q129: Refer to Figure 4-4.The figure above represents

Q137: A partnership can raise funds for expansion

Q138: Consider a country that produces only two

Q142: If the sales of carbonated sodas continue

Q155: Assume that the demand curve for DVD

Q203: If,in a competitive market,marginal benefit is greater

Q204: For each pound of salami that Hungary

Q206: Refer to Table 2-6.What is Lucy's opportunity