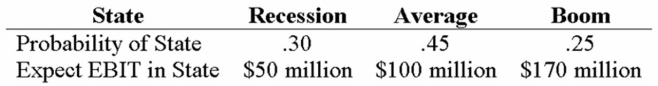

Your company doesn't face any taxes and has $500 million in assets, currently financed entirely with equity. Equity is worth $40 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

Definitions:

Thematic Parallels

The drawing of comparisons between two different subjects, highlighting common themes or underlying messages found within both.

BBS Productions

A film production company known for its involvement in the New Hollywood movement, producing films like "Easy Rider."

Independently Produced

Films made outside of the major film studio system, often characterized by lower budgets, creative control by the filmmakers, and innovative storytelling techniques.

Italian American

A citizen of the United States of American descent who has Italian ancestry, contributing to the cultural and social fabric of American society.

Q8: This is the mix of debt and

Q14: The managers of State Bank have been

Q23: Suppose a firm has had the historical

Q24: The nurse is caring for a patient

Q39: Your company doesn't face any taxes and

Q41: Carrying costs are associated with having current

Q86: You have been asked by the president

Q86: Calculating Costs of Issuing Stock Your company

Q92: This is the idea that it does

Q120: Suppose that Dunn Industries has annual sales