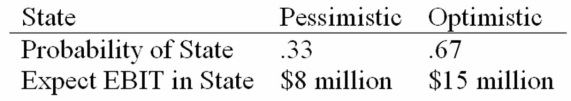

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the break-even level of EBIT?

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the break-even level of EBIT?

Definitions:

Market Value

The amount for which something can be sold on a given market.

Dividends

Payments made by a corporation to its shareholder members, usually derived from the company's profits.

Common Stock

Common stock represents ownership shares in a corporation, giving holders voting rights and the potential to receive dividends.

Long-term Investment

Investments held for an extended period, typically more than one year, with the intention of earning returns over time.

Q6: Suppose a firm has had the historical

Q23: Which of the following tools is suitable

Q25: Convert each of the following indirect quotes

Q63: Compute the MIRR statistic for Project I

Q63: The set of assumptions underlying the firm's

Q77: Calculating Fees on a Loan Commitment During

Q81: Which of the following is true regarding

Q94: Use the NPV decision rule to evaluate

Q100: When calculating operating cash flow for a

Q109: A firm has retained earnings of $11