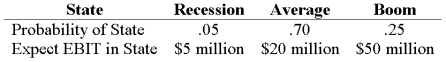

Your company has a 25% tax rate and has $600 million in assets, currently financed entirely with equity. Equity is worth $20 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?

Definitions:

Peripheral Organs

Peripheral organs refer to the organs and systems located outside of the central nervous system, mainly involved in carrying out the specific functional tasks of the body.

CCK

Cholecystokinin (CCK) is a hormone that stimulates the digestion of fat and protein by releasing bile from the gallbladder and digestive enzymes from the pancreas.

Genetically Obese Rats

Rats that become obese due to genetic predispositions, often used in studies to understand obesity in humans.

Lateral Hypothalamus

A part of the hypothalamus in the brain that plays a significant role in controlling hunger and thirst.

Q24: If a firm has excess capacity when

Q34: Which of the following is defined as

Q45: Calculation of Altman's Z-Score: Use the following

Q53: If a firm has retained earnings of

Q54: Which of the following will increase a

Q75: Calculating Costs of Issuing Stock Saddles and

Q77: Calculation of Bankruptcy Probability Suppose a linear

Q97: This technique for evaluating capital projects is

Q103: Your company has spent $200,000 on research

Q108: Suppose a firm pays total dividends of