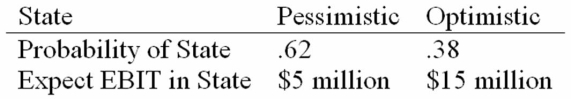

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

Definitions:

Testosterone

A primary male sex hormone crucial for the development of male reproductive tissues, as well as promoting secondary sexual characteristics.

Secondary Male Characteristics

Physical changes that occur in males during puberty, such as facial hair, voice deepening, and increased muscle mass, not directly involved in reproduction.

Vas Deferens

A tube that transports sperm from the testicle to the urethra in males.

Surgery

A medical procedure involving the incision or manipulation of tissues to repair or remove pathological conditions.

Q4: If a firm has a cash cycle

Q7: Triangular Arbitrage The U.S. dollar spot exchange

Q23: Given these two exchange rates, $1 =

Q40: Which of the following is the type

Q41: Currency Exchange Compute the amount of foreign

Q48: A financial asset will pay you $10,000

Q49: A firm has retained earnings of $11

Q80: You are evaluating a project for your

Q90: Compute the PI statistic for Project Q

Q94: Which of the following is NOT one