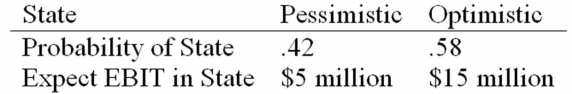

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

Definitions:

Reinforcement Processes

Methods and principles used to increase or decrease the likelihood of a behavior's occurrence through consequences or rewards.

Cultural Distance

is the measure of how different one culture is from another, which can affect international business operations, communication, and negotiation.

Acquisitions

The act of obtaining or taking possession of something, often referring to a company's purchase of another company.

Individualistic Culture

Characterizes societies that prioritize the needs and goals of the individual over those of the group, often associated with personal independence, self-expression, and a lower degree of social connection.

Q8: This is the mix of debt and

Q20: A capital budgeting technique that generates a

Q30: Goldilochs Inc. reported sales of $8 million

Q31: Convert each of the following indirect quotes

Q37: Which of the following can be computed

Q46: Which of the following statements is incorrect?<br>A)

Q48: A decrease in net working capital (NWC)

Q50: Which of the following is a true

Q59: The merged firm's ability to generate synergistic

Q68: Which of these is defined as the