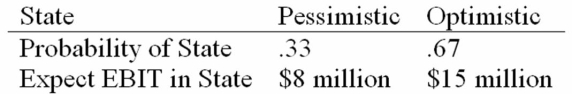

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the standard deviation in EPS if they switch to the proposed capital structure?

Definitions:

Dependence

A state in which there is a physical or psychological compulsion to take a substance or engage in an activity, often leading to addiction.

Anabolic Steroids

Synthetic substances similar to the male hormone testosterone, used to increase muscle mass and strength, often with harmful health effects.

Muscle Mass

The total amount of skeletal muscle in the body, important for physical strength, metabolism, and overall health.

Body Fat

The portion of an individual's body that is made up of fat cells, vital for energy storage, protection of internal organs, and regulation of hormones.

Q1: Suppose you sell a fixed asset for

Q7: Would it be worth it to incur

Q8: Candy Town, Inc. normally pays a quarterly

Q22: Which of the following statements is correct?<br>A)

Q30: George's Dry Cleaning is considering a merger

Q33: Goldilochs Inc. reported sales of $8 million

Q38: Which of the following is incorrect with

Q41: Carrying costs are associated with having current

Q93: Which of the following is NOT a

Q103: Which of the following statements is incorrect?<br>A)