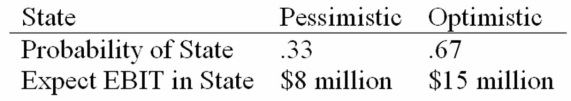

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the break-even level of EBIT?

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the break-even level of EBIT?

Definitions:

Malleus

A small bone in the middle ear that plays a crucial role in the transmission of sound vibrations to the inner ear.

Cerumen

A scientific term for earwax, a substance produced in the ear canal that protects the ears by trapping dirt and slowing the growth of bacteria.

Organ of Corti

A structure located in the cochlea of the inner ear, responsible for converting sound vibration into nerve impulses.

Basilar Membrane

A key structure in the cochlea of the inner ear, crucial for the perception of sound as it vibrates in response to sound waves.

Q8: Candy Town, Inc. normally pays a quarterly

Q20: Your company doesn't face any taxes and

Q21: Calculating Costs of Issuing Stock TV Technology

Q43: Compute the PI statistic for Project X

Q51: China's exchange rate is a _.<br>A) Freely

Q57: Calculation of Average Costs with Economies of

Q83: Calculating Costs of Issuing Debt Roy's Bar,

Q103: A project has normal cash flows. Its

Q105: A financial asset will pay you $50,000

Q121: A U.S. firm is expecting to pay