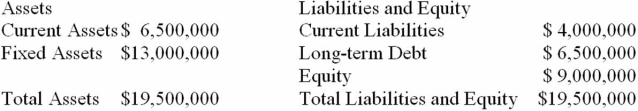

Suppose that Wave Industries currently has the balance sheet shown below, and that sales for the year just ended were $25 million. The firm also has a profit margin of 10 percent, a retention ratio of 20 percent, and expects sales of $27 million next year. If fixed assets have enough capacity to cover the increase in sales and all other assets and current liabilities are expected to increase with sales, what amount of additional funds will the company need from external sources to fund the expected growth?

Definitions:

Q8: Candy Town, Inc. normally pays a quarterly

Q15: Imagine a firm has a temporary surplus

Q50: Sipe's Paint and Wallpaper, Inc., needs to

Q51: Which of these is the requirement of

Q70: If a firm has a cash cycle

Q70: The advantage of the shelf registration is

Q72: Suppose that Wind Em Corp. currently has

Q88: Suppose a firm has had the historical

Q90: Suppose a firm has had the historical

Q103: Which of the following statements is incorrect?<br>A)