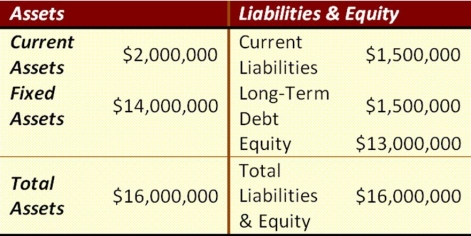

Suppose that Gyp Sum Industries currently has the balance sheet shown below, and that sales for the year just ended were $20 million. The firm also has a profit margin of 22 percent, a retention ratio of 42 percent, and expects sales of $30 million next year. If all assets and current liabilities are expected to grow with sales, how much additional funds will Gyp Sum need from external sources to fund the expected growth?

Definitions:

Perfect Competition

A market structure where many firms sell identical products, entry and exit are easy, and no single buyer or seller can affect prices.

Marginal Cost (MC)

The increase in total cost that results from producing 1 more unit of output. Marginal costs reflect changes in variable costs.

Marginal Cost

The financial increment incurred by the production of an extra unit of a product or service.

Average Total Cost

It refers to the total cost per unit of output, calculated by dividing the total cost of production by the number of units produced.

Q10: Elle Mae Industries has a cash balance

Q22: What would be the appropriate way to

Q29: TJ Corp. is expected to pay a

Q36: The current spot rate between the U.S.

Q45: Your company has a 25% tax rate

Q51: Suppose that TV Industries, Inc. currently has

Q69: Which strategy, active or passive capital structure

Q73: ABC Corp. is expected to pay a

Q90: All of the following are examples of

Q99: If a popular video gaming system costs