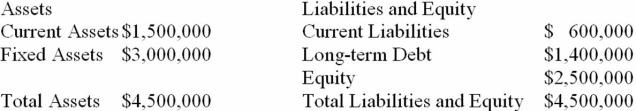

Suppose that Runner Industries currently has the balance sheet shown below, and that sales for the year just ended were $5 million. The firm also has a profit margin of 10 percent, a retention ratio of 20 percent, and expects sales of $7 million next year. If fixed assets have enough capacity to cover the increase in sales and all other assets and current liabilities are expected to increase with sales, what amount of additional funds will the company need from external sources to fund the expected growth?

Definitions:

Q10: Use the payback decision rule to evaluate

Q11: MC Enterprises estimates that it takes, on

Q14: Rose Axels faces a smooth annual demand

Q22: KADS, Inc. has spent $400,000 on research

Q26: Safety stock is referred to as the

Q50: If the spot rate between the U.S.

Q50: Which of the following is a true

Q61: Which of the following is a security

Q97: Exchange Rate Quote Convert the following direct

Q129: If a firm has a cash cycle