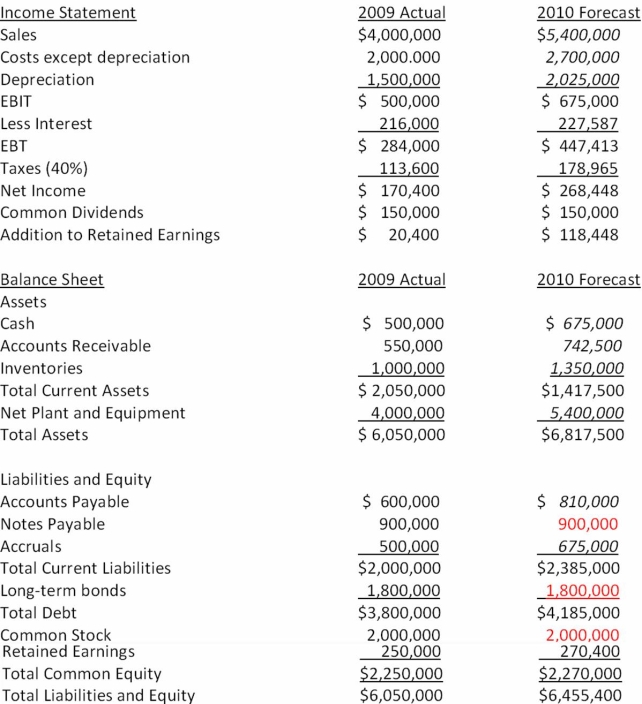

Suppose that the 2009 actual and 2010 projected financial statements for Counter Corp are initially as shown below. In these tables, sales are projected to rise 35 percent in the coming year, and the components of the income statement and balance sheet that are expected to increase at the same 35 percent rate as sales are indicated with an italics font. Assuming that Counter Corp wants to cover the AFN with 60 percent equity, 25 percent long-term debt, and the remainder from notes payable, what amount of additional funds will they need to raise if debt carries an 8 percent interest rate?

Definitions:

Statistically Significant

A determination that a result from data analysis is not likely to have occurred by chance alone, indicating a true effect or difference.

Mathematical Calculations

The process of performing operations on numbers or symbols according to systematic rules to arrive at a result or solution.

Chance Guessing

Making a selection without any particular knowledge, reason, or method, relying on pure random choice.

Subtle Sounds

Low-intensity auditory stimuli that might not be immediately obvious but can nevertheless influence mood, perception, or behavior.

Q7: Use the payback decision rule to evaluate

Q26: A firm has retained earnings of $6

Q36: Suppose that Psy Ops Industries currently has

Q38: Which of the following is incorrect with

Q47: An all-equity financed firm has $500 in

Q70: The advantage of the shelf registration is

Q93: The MIRR statistic is different from the

Q110: Which of the following statements is correct?<br>A)

Q110: Suppose a firm pays total dividends of

Q120: Exchange Rate Risk A U.S. firm is