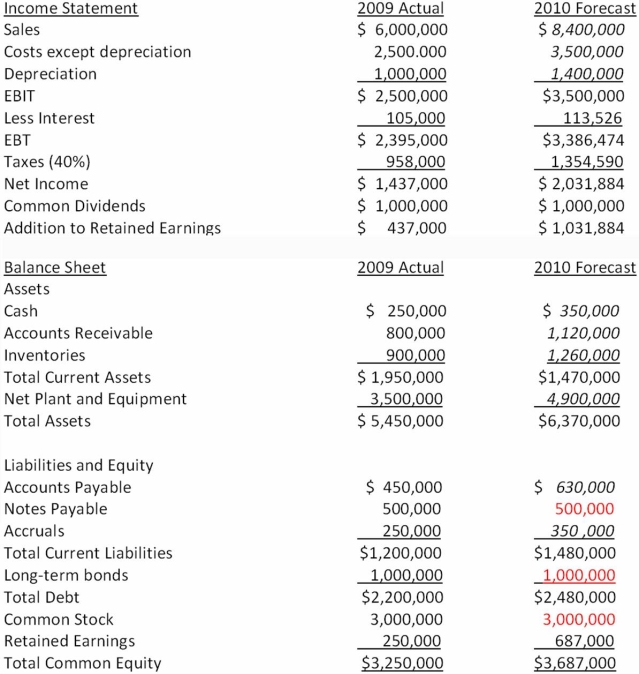

Suppose that the 2009 actual and 2010 projected financial statements for Camera Corp are initially as shown below. In these tables, sales are projected to rise 40 percent in the coming year, and the components of the income statement and balance sheet that are expected to increase at the same 40 percent rate as sales are indicated with an italics font. Assuming that Camera Corp wants to cover the AFN with 40 percent equity, 30 percent long-term debt, and the remainder from notes payable, what amount of additional funds will they need to raise if debt carries a 7 percent interest rate?

Definitions:

Apical/Radial Pulse

Measurements of the heartbeat taken at the apex of the heart and the radial artery of the wrist, respectively.

Blood Pressure

The force exerted by circulating blood on the walls of the body's arteries, a crucial indicator of cardiovascular health.

Blood Pressure Device

A medical instrument used to measure the pressure of blood in the arteries.

Heart Rhythms

The pattern of beats produced by the heart as it pumps blood through the body, which can be regular or irregular.

Q19: To correctly project cash flows, we need

Q21: Suppose a firm has a retention ratio

Q28: If a firm has a cash cycle

Q34: Currency Exchange Compute the number of dollars

Q51: China's exchange rate is a _.<br>A) Freely

Q61: Use the discounted payback decision rule to

Q67: Exchange Rate Quote Convert the following indirect

Q87: A security issued in which the underwriter

Q99: Which of the following is an unsecured

Q118: You have approached your local bank for