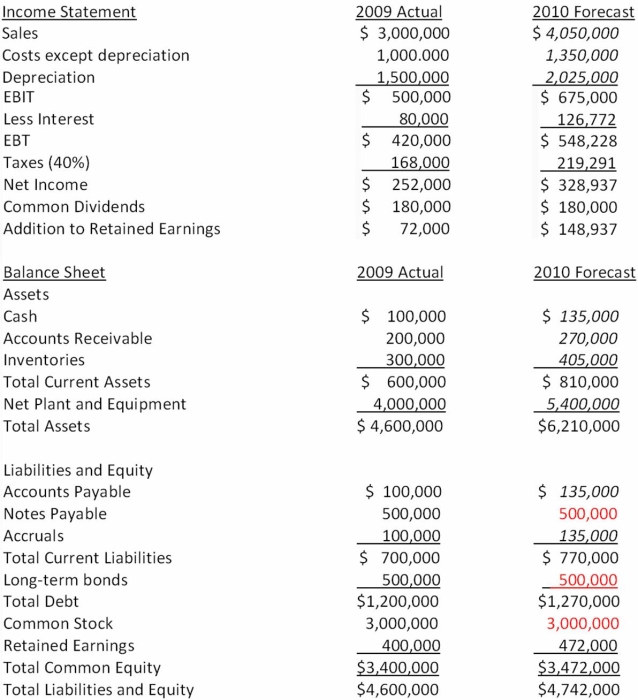

Suppose that the 2009 actual and 2010 projected financial statements for Cramner Corp are initially as shown below. In these tables, sales are projected to rise 35 percent in the coming year, and the components of the income statement and balance sheet that are expected to increase at the same 35 percent rate as sales are indicated with an italics font. Assuming that Cramner Corp wants to cover the AFN with 45 percent equity, 25 percent long-term debt, and the remainder from notes payable, what amount of additional funds will they need to raise if debt carries an 8 percent interest rate?

Definitions:

General Partnership

A business structure where two or more partners share unlimited liability for the company's debts and obligations.

Capital Account

An account on a nation's balance of payments that records investments and loans between the country and the rest of the world.

Revaluation

The process of adjusting the book value of a currency, asset, or liability to reflect its current market value.

Income Sharing

An agreement or policy where generated income is distributed among participants or stakeholders based on pre-defined criteria or ratios.

Q5: For most businesses, particularly smaller ones, the

Q24: A policy of a firm paying out

Q48: No Nuns Cos. has a 20 percent

Q50: An all-equity firm is considering the projects

Q58: GBH Inc. is planning on announcing a

Q81: Which of the following is NOT a

Q104: If a firm's inventory ratio increases, what

Q107: Suppose you sell a fixed asset for

Q113: Which of the following current asset financing

Q126: All of the following are the different