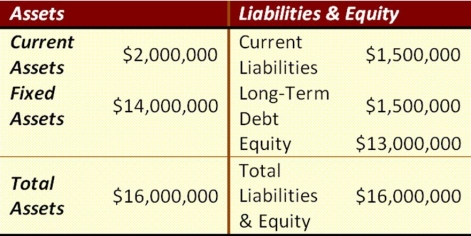

Suppose that Gyp Sum Industries currently has the balance sheet shown below, and that sales for the year just ended were $20 million. The firm also has a profit margin of 22 percent, a retention ratio of 42 percent, and expects sales of $30 million next year. If all assets and current liabilities are expected to grow with sales, how much additional funds will Gyp Sum need from external sources to fund the expected growth?

Definitions:

Q19: The operating cycle will increase with all

Q23: Calculating Fees on a Loan Commitment You

Q28: Compute the NPV for Project X and

Q31: ADK has 30,000 15-year 9% annual coupon

Q32: Goldilochs Inc. reported sales of $8 million

Q59: JAY Corp. is expected to pay a

Q65: All of the following capital budgeting tools

Q66: Suppose that Model Nails, Inc.'s capital structure

Q77: China's exchange rate is pegged to _.<br>A)

Q82: Compute the number of dollars that can