Multiple Choice

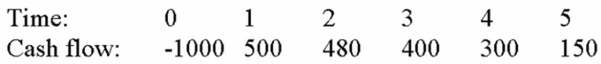

Compute the Discounted Payback statistic for Project X and recommend whether the firm should accept or reject the project with the cash flows shown below if the appropriate cost of capital is 10 percent and the maximum allowable discounted payback is 3 years.

Interpret laboratory findings related to metabolic and respiratory processes.

Understand fluid dynamics and their impact on patient health, including edema formation and fluid management.

Safely manage intravenous therapy, including IV line management and blood transfusions.

Recognize and prevent potential complications of intravenous therapy.

Definitions:

Related Questions

Q30: KADS, Inc. has spent $400,000 on research

Q33: HiLo, Inc., doesn't face any taxes and

Q34: A firm is evaluating a potential investment

Q35: Explain why, in a world with both

Q62: Which liabilities would tend to spontaneously increase

Q85: Stock A has a required return of

Q90: Suppose a firm has had the historical

Q90: You are considering the purchase of one

Q94: Which of the following is NOT one

Q97: This technique for evaluating capital projects is