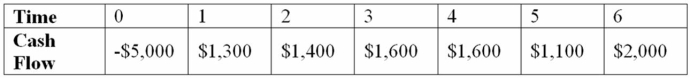

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Ebbinghaus Forgetting Curve

A model depicting the decrease in the ability to recall information over time, suggesting that memory fades rapidly initially, then levels off.

Memory Trace

A theoretical concept referring to the physical change in the brain that represents a storage of knowledge.

Gradual Loss

A slow diminution or decline in value, quality, or quantity over time.

Anterograde Amnesia

A condition where a person is unable to form new memories after the event that caused the amnesia, although long-term memories from before the event remain intact.

Q1: Goldilochs Inc. reported sales of $8 million

Q10: A new project would require an immediate

Q24: If a firm has excess capacity when

Q28: Compute the NPV for Project X and

Q36: Suppose that Psy Ops Industries currently has

Q75: Scribble, Inc. has sales of $80,000 and

Q84: This technique for evaluating capital projects tells

Q101: This is a principle of capital budgeting

Q105: Operating cycle is measured as:<br>A) Inventory Turns

Q108: Why would a firm ever use short-term