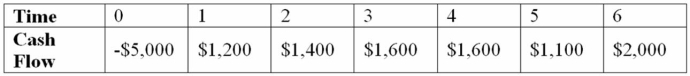

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the IRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Q5: XYZ Industries has 10 million shares of

Q12: Consider the following correlations: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2392/.jpg" alt="Consider

Q26: An all-equity firm is considering the projects

Q29: TJ Corp. is expected to pay a

Q29: The constant growth model requires what information

Q77: You are evaluating a product for your

Q86: You have been asked by the president

Q93: Which of the following would cause dividends

Q113: Suppose that Glamour Nails, Inc.'s capital structure

Q116: A financial analyst calculated that the after-tax