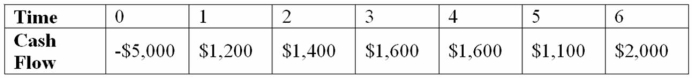

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the NPV decision to evaluate this project; should it be accepted or rejected?

Definitions:

Inventory Item

An inventory item refers to any goods or merchandise kept on hand by a business for the purpose of resale to customers.

Physical Inventory

A count of all inventory a business physically has in its possession at a specific point in time.

Income Statement

A financial statement that shows a company's revenues, expenses, and net income or loss over a specific period of time, providing insight into its profitability.

Inventory Turnover Ratio

A metric indicating how often a company sells and replaces its stock of goods during a particular period.

Q10: An all-equity financed firm has $350 in

Q10: Use the payback decision rule to evaluate

Q22: KADS, Inc. has spent $400,000 on research

Q27: CJ Corp. is expected to pay a

Q66: Suppose that Model Nails, Inc.'s capital structure

Q76: A manufacturing firm is planning on expanding

Q79: Suppose that Lil John Industries' equity is

Q86: The additional funds needed by the firm

Q98: Compute the standard deviation of Kohl's monthly

Q99: A project costs $91,000 today and is