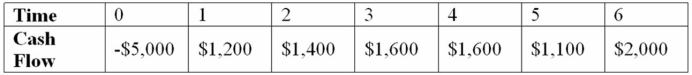

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the PI decision to evaluate this project; should it be accepted or rejected?

Definitions:

Value of the Marginal Product

The additional revenue generated by employing one more unit of a factor, holding all else constant.

Marginal Product

The additional output that is produced by adding one more unit of a specific input, while holding other inputs constant.

Price Per Unit

The cost of a single unit of a product, often used to compare different product costs directly.

Moisture Farm

A fictional type of farm found in science fiction, particularly in the Star Wars universe, designed for the collection and harvesting of water from the atmosphere.

Q5: What would prompt a firm like GE

Q25: Coke is planning on marketing a new

Q32: A stock has an expected return of

Q42: Suppose that a firm always announces a

Q65: Portfolio Weights If you own 1000 shares

Q77: You are evaluating a product for your

Q83: Why is debt often referred to as

Q89: Which of the following is likely to

Q92: Suppose that Papa Bell Inc.'s equity is

Q98: Compute the standard deviation of Kohl's monthly