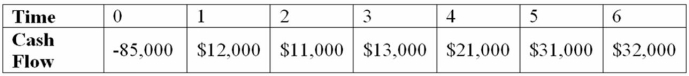

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3 and 3.5 years, respectively. Use the payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Observed Frequencies

The actual number of occurrences or instances recorded in categorized data.

Null Hypothesis

A statement in statistics that there is no significant difference or effect, and any observed difference is due to chance.

Multinomial Experiment

An experiment that extends binomial trials, allowing for more than two possible outcomes for each trial.

Observed Frequencies

The number of occurrences or instances of data points in specified categories or intervals as collected from experiments or surveys.

Q17: Which of the following statements is correct?<br>A)

Q25: Coke is planning on marketing a new

Q47: This is a repurchase where the firm

Q48: Suppose a firm has a dividend payout

Q57: Which of the following statements is correct

Q79: This is a measure of risk to

Q79: Which of the following is NOT included

Q81: Suppose your firm is considering investing in

Q83: With regard to depreciation, the time value

Q113: Suppose that Glamour Nails, Inc.'s capital structure