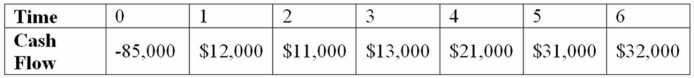

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the discounted payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Technological Attributes

Characteristics or features of technology, including hardware and software, that define their capabilities, functionalities, and performance.

Project Complexity

A measure of the various intricate factors and elements within a project, including its structure, governance, and uncertainty levels, that can affect its execution and outcome.

Technological Sophistication

The level of advanced technological features, innovation, and capabilities within an organization or system.

Technological Compatibility

The extent to which a technology fits and functions well within a particular system or environment without conflict.

Q2: Expected Return A company's current stock price

Q4: The least-used capital budgeting technique in industry

Q50: Use the PI decision rule to evaluate

Q56: Use the MIRR decision rule to evaluate

Q63: The optimal portfolio for you will be

Q76: If a firm has retained earnings of

Q79: Suppose your firm has decided to use

Q79: Use the discounted payback decision rule to

Q114: JAK Industries has 5 million shares of

Q128: Happy Feet would like to maintain their