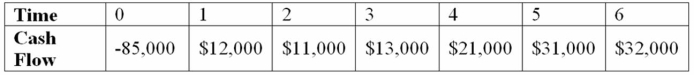

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the NPV decision to evaluate this project; should it be accepted or rejected?

Definitions:

Omission Lying

Deliberately withholding important information or truths, considered a form of deception.

Safety Warnings

Notifications provided on products or in environments to alert individuals about potential hazards and how to avoid them.

Dual Relationship

A situation where multiple roles exist between a professional and a client, potentially leading to conflicts of interest or ethical dilemmas.

Professional Responsibilities

Entails the duties and obligations that individuals are expected to fulfill as part of their professional role, adhering to ethical standards and practices of their field.

Q3: A company is considering two mutually exclusive

Q10: Rose has preferred stock selling for 99

Q26: Safety stock is referred to as the

Q48: No Nuns Cos. has a 20 percent

Q67: What are two issues that are not

Q73: Use the payback decision rule to evaluate

Q99: Expected Return Risk Compute the standard deviation

Q100: An objective approach to calculating divisional WACCs

Q107: Average Return The past five monthly returns

Q129: If a firm has a cash cycle