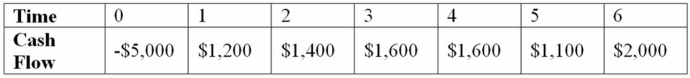

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the discounted payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Normally Distributed

A statistical distribution where data points are symmetrically distributed around the mean, forming a bell-shaped curve.

Standard Deviation

An indicator of the degree to which a dataset's values vary or are spread, showing the distance of the values from the average.

Probability

The measure or quantification of how likely an event is to occur, expressed as a number between 0 (impossible) and 1 (certain).

NORM.DIST

A function in statistics that returns the normal distribution for a specified mean and standard deviation.

Q16: If you invested $1,000 in Disney and

Q30: KADS, Inc. has spent $400,000 on research

Q33: This is defined as the volatility of

Q45: Explain the Rule of Signs as it

Q47: This is a repurchase where the firm

Q83: Use the NPV decision rule to evaluate

Q93: In 2000, the S&P500 Index earned 11%

Q95: If a firm is going to take

Q105: This is a situation that arises when

Q114: JAK Industries has 5 million shares of