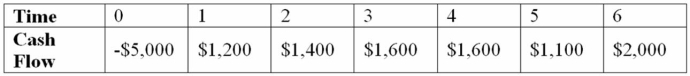

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the IRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Fair Value

The estimated market value of an asset or liability in an arm's length transaction between informed and willing parties.

Investment Income

Income received from the assets invested in, such as dividends, interest, or rental income.

Common Stock

Shares of ownership in a corporation that grant holders voting rights and a share of the company’s profits through dividends.

Long-Term Investment

Investments a company intends to hold for more than one year, typically including stocks, bonds, or real estate.

Q5: What would prompt a firm like GE

Q11: Fern has preferred stock selling for 95

Q13: Which of the following makes this a

Q30: Goldilochs Inc. reported sales of $8 million

Q34: Suppose that Hanna Nails, Inc.'s capital structure

Q41: Dominant Portfolios Determine which one of these

Q41: Carrying costs are associated with having current

Q74: What type of clientele would you expect

Q90: If a firm has a cash cycle

Q119: Suppose a new project was going to