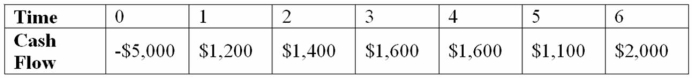

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the NPV decision to evaluate this project; should it be accepted or rejected?

Definitions:

Multiple Births

The delivery of more than one baby from the same pregnancy, such as twins or triplets.

Canalized Traits

Genetic characteristics that are not easily changed by environmental factors due to their strong genetic control.

Genetic Relationship

The connection between organisms based on the similarity of their DNA sequences.

Nonshared Environmental

Influences that result in differences among siblings, including experiences outside the family that are not shared by other siblings.

Q6: A financial analyst calculated that the after-tax

Q8: Which of the following is correct regarding

Q11: All of the following can be included

Q15: Imagine a firm has a temporary surplus

Q24: AB Mining Company just commissioned a firm

Q34: Suppose that Hanna Nails, Inc.'s capital structure

Q42: Which of the following is NOT a

Q67: Use the PI decision rule to evaluate

Q104: Which of the following would cause dividends

Q109: You are trying to pick the least-expensive