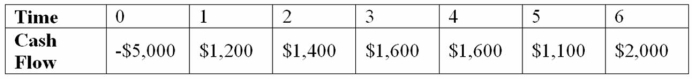

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 8 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the MIRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Persuasion

The act or process of influencing someone's beliefs, attitudes, or behaviors through argument, appeal, or reasoning.

Coercion

The practice of persuading someone to do something by using force or threats.

Manipulation

The act of controlling or influencing a person or situation cunningly or unfairly, often to serve one's own interests.

Cognitive Dissonance

A psychological phenomenon occurring when an individual experiences mental discomfort from holding two or more contradictory beliefs, values, or ideas simultaneously.

Q30: Cups N Saucers, Inc. normally pays a

Q38: Which of the following is incorrect with

Q43: Which of the following statements is correct?<br>A)

Q44: Happy Feet would like to maintain their

Q54: Expected Return and Risk Compute the standard

Q57: You are evaluating a project for The

Q58: Hastings Entertainment has a beta of 1.24.

Q62: Your company is considering the purchase of

Q64: Which of the following current asset financing

Q75: Consider an asset that provides the same