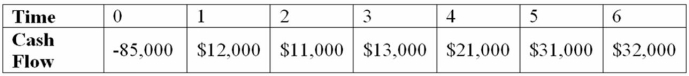

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3 and 3.5 years, respectively. Use the payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Company Gate

The primary entry point for individuals into a company's physical premises, symbolizing access control and security measures.

VPN

Virtual Private Network, a technology that creates a safe and encrypted connection over a less secure network, such as the internet, allowing secure remote access to network resources.

Risk Transference

A risk management technique where the potential for loss or damage is shifted from one party to another, often through insurance or contracts.

Security Insurance

Financial products or services that provide protection against losses from cybersecurity incidents or data breaches.

Q2: A firm uses only debt and equity

Q3: Accelerated depreciation allows firms to<br>A) receive less

Q6: What two main factors come into play

Q7: Forecasted sales drives all of the following

Q36: A measure of the sensitivity of a

Q62: The _ approach to computing a divisional

Q67: Which of these statements is true?<br>A) When

Q84: If a firm changes their capital structure

Q84: The first day that the shares will

Q101: This is the term for portfolios with