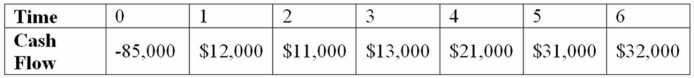

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the discounted payback decision to evaluate this project; should it be accepted or rejected?

Definitions:

Internal

Pertains to elements or operations within an organization or system.

External

Originating from or existing outside the organization or entity in question.

HR Gap

The difference between the current capabilities of the workforce and the skills required to achieve organizational goals.

Human Capital

The collection of skills, knowledge, and experience possessed by an individual or workforce, viewed in terms of their value or cost to an organization.

Q4: Which of the following is a set

Q11: Brady inherited 1000 shares of LNM, Inc.

Q29: Effects that arise from a new product

Q32: Goldilochs Inc. reported sales of $8 million

Q38: Which of the following statements is correct?<br>A)

Q42: Your company is considering the purchase of

Q61: Goldilochs Inc. reported sales of $8 million

Q73: CAPM Required Return A company has a

Q97: If a firm has a cash cycle

Q97: Your firm needs a machine which costs