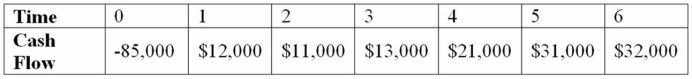

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the IRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Pareto Optimal

A state of allocation of resources from which it is impossible to reallocate without making at least one individual or preference criterion worse off.

Marginal Rate of Substitution (MRS)

The marginal rate of substitution is the rate at which a consumer is willing to substitute one good for another while keeping the utility level constant.

Cobb-Douglas Utility Functions

A mathematical representation of consumer preferences that shows how utility depends on the consumption of different goods, characterized by constant elasticity of substitution.

Pareto Optimal

A state of allocation of resources from which it is impossible to reallocate to make any one individual or preference criterion better off without making at least one individual or preference criterion worse off.

Q26: Calculate the rate at which the follow

Q33: Which of the following will directly impact

Q46: Use the PI decision rule to evaluate

Q69: Which of the following is described as

Q70: If a firm has a cash cycle

Q76: If a firm has retained earnings of

Q76: Land O Lakes Systems has a beta

Q89: How can an investor leverage itself more

Q92: This is used as a measure of

Q94: Suppose that a firm always announces a