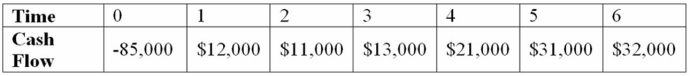

Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 10 percent, and that the maximum allowable payback and discounted payback statistics for the project are 3.5 and 4.5 years, respectively. Use the MIRR decision to evaluate this project; should it be accepted or rejected?

Definitions:

Neuron

A nerve cell that is the basic building block of the nervous system, responsible for receiving, processing, and transmitting information through electrical and chemical signals.

Axons

Long, slender projections of nerve cells that transmit electrical impulses away from the neuron's cell body.

Axon Terminals

The very end of a branch of a neuron's axon, a region where neurotransmitters are stored before being released into the synaptic cleft.

Peripheral Nerves

Nerves located outside the brain and spinal cord that connect the central nervous system to limbs and organs, essentially serving as communication lines.

Q28: List and explain all the components of

Q45: Which of the following would cause dividends

Q55: You have been asked by the president

Q72: A firm uses only debt and equity

Q74: Which of the following statements is correct?<br>A)

Q81: Suppose your firm is considering investing in

Q82: Suppose that Road Industries currently has the

Q94: Which of the following is NOT one

Q110: Investment Return WayCo stock was $75 per

Q121: Compute the NPV for Project X and