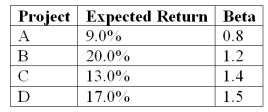

An all-equity firm is considering the projects shown below. The T-bill rate is 3% and the market risk premium is 6%. If the firm uses its current WACC of 12% to evaluate these projects, which project(s) , if any, will be incorrectly rejected?

Definitions:

Conscious Awareness

The condition of being conscious of one's own being, feelings, ideas, and environment.

Painful Memories

Recollections from the past that cause emotional distress and discomfort when remembered or recalled.

Paranoia

A mental condition characterized by irrational suspicions and mistrust of others, often without sufficient basis.

Thalamus

A small structure within the brain that serves as a relay station for information between the cerebral cortex and the rest of the nervous system.

Q3: A proxy beta is _.<br>A) the average

Q7: Which of the following is NOT a

Q20: Dominant Portfolios Determine which one of these

Q26: Which of the following is correct?<br>A) Hedge

Q30: Average Return The past five monthly returns

Q42: A firm's recent dividend was $4.00 per

Q71: Which of the following is an electronic

Q76: Suppose that Tan Lotion's common shares sell

Q80: You are evaluating a project for your

Q113: You are evaluating two different machines. Machine