Multiple Choice

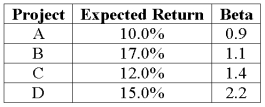

An all-equity firm is considering the projects shown below. The T-bill rate is 3 percent and the market risk premium is 6 percent. If the firm uses its current WACC of 12 percent to evaluate these projects, which project(s) will be incorrectly rejected?

Understand the components and importance of creativity in intelligence.

Acknowledge the role of environmental factors on intelligence.

Grasp historical changes in intelligence assessment, including the Flynn Effect.

Understand the significance of heredity and environment in determining intelligence.

Definitions:

Related Questions

Q11: The efficient frontier portfolios are _.<br>A) portfolios

Q20: Which of the following will increase the

Q29: If a firm has a cash cycle

Q34: A firm is expected to pay a

Q54: Value a Constant Growth Stock Financial analysts

Q76: Which of these statements answers why bonds

Q83: With regard to depreciation, the time value

Q87: Portfolio Beta You own $2,000 of City

Q94: Bond Prices and Interest Rate Changes A

Q98: Which of the following statements is correct