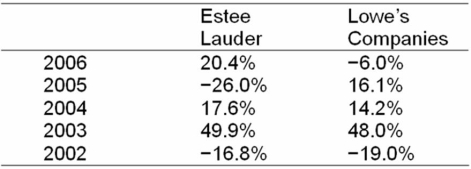

Consider the following annual returns of Estee Lauder and Lowe's Companies:  Compute each stock's average return, standard deviation, and coefficient of variation.

Compute each stock's average return, standard deviation, and coefficient of variation.

Definitions:

Behaviour

The actions or reactions of a person or system in response to external or internal stimuli.

Contribution Margin

The amount remaining from sales revenue after variable expenses have been deducted, contributing to covering fixed expenses and profit.

Variable Expenses

Expenditures that change in direct relation to production levels or sales quantities.

Mixed Cost

A cost composed of a mixture of fixed and variable components. Costs are fixed for a set level of production or consumption, becoming variable with further production or consumption.

Q13: Which of the following makes this a

Q29: A fast growing firm recently paid a

Q46: Sprint Nextel Corp stock ended the previous

Q50: You own $9,000 of Olympic Steel stock

Q59: Sharif's portfolio generated returns of 12%, 15%,

Q75: Consider an asset that provides the same

Q81: Suppose your firm is considering investing in

Q82: Use the MIRR decision rule to evaluate

Q96: Changes in Growth and Stock Valuation Consider

Q114: This is the IRS convention that requires