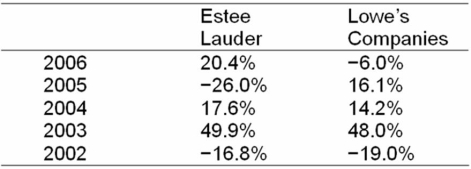

Consider the following annual returns of Estee Lauder and Lowe's Companies:  Compute each stock's average return, standard deviation, and coefficient of variation.

Compute each stock's average return, standard deviation, and coefficient of variation.

Definitions:

Extracellular Matrix

A complex network of proteins and carbohydrates outside of cells that provides structural and biochemical support to surrounding cells.

Integrins

A family of cell adhesion molecules that are involved in the attachment of a cell to the extracellular matrix or other cells, playing critical roles in cell signaling and migration.

ATP

Adenosine triphosphate, a molecule that provides energy for many processes within living cells.

Extracellular Matrix

A complex network of proteins and carbohydrates surrounding cells, providing structural and biochemical support to surrounding cells.

Q6: When saving for future expenditures, we can

Q25: The past five monthly returns for PG&E

Q31: ADK has 30,000 15-year 9% annual coupon

Q54: Why do we use market-based weights instead

Q68: Which of the following statements is correct?<br>A)

Q75: Taxable Equivalent Yield What's the taxable equivalent

Q100: Present Value of an Annuity What is

Q105: Present Value Given a 4 percent interest

Q116: Trading at physical exchanges like the New

Q122: TJ Industries has 7 million shares of