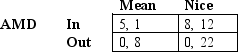

Suppose AMD is considering cloning Intel's latest CPU chip. If AMD enters Intel's market, Intel can play Mean, expand its output, drop prices, and try to make AMD's profit as small as possible or play Nice by cutting back its output and sharing the market. AMD and Intel both know that after all moves are complete, the time-discounted profits of future chip production in billions of dollars are Intel Assuming AMD moves first, which of the following is the Nash equilibrium for sequential play?

Assuming AMD moves first, which of the following is the Nash equilibrium for sequential play?

Definitions:

Observation

The action or process of closely monitoring or watching something or someone, often used as a method in scientific research or studies.

Experimentation

A method in scientific research used to test hypotheses and theories through controlled and structured testing.

Association for Psychological Science

A professional organization dedicated to the advancement of scientific psychology and its representation at the national and international level.

Empirical Findings

Information and knowledge acquired by means of observation or experimentation that are grounded in empirical evidence.

Q5: If a monopolist faces a competitive labor

Q6: Why might a profit-maximizing firm producing a

Q8: Abduls utility is U(X A, Y A

Q17: Neville, in Problem 2, has a friend

Q20: The Sons of Knute had a hunting

Q24: The Hard Times Concrete Company is a

Q25: Charlie can work as many hours as

Q26: North American Manufacturing has the production function

Q30: A competitive firm uses two variable factors

Q59: In a pure exchange economy, Ollie's utility