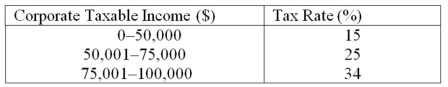

What are the average and marginal tax rates for a corporation that has $97,648 of taxable income? The tax rates are as follows:

Definitions:

Intelligence Level

A measure of one's cognitive abilities, including the ability to learn, understand, reason, plan, and solve problems, often assessed through standardized intelligence tests.

Deviation IQ Scores

A method of calculating an individual's IQ score relative to the average IQ scores of their age group.

Intelligence Test Scores

Quantitative measures obtained from assessments designed to evaluate a person's cognitive abilities in relation to their age group.

Intelligence Quotients

A measure of a person's intellectual abilities in relation to an average score, determined by standardized tests.

Q24: How can an analyst feel comfortable in

Q35: The concept of compound interest refers to:<br>A)

Q36: The rates of return on investments outside

Q37: In the context of international marketing, the

Q41: How much must be invested today in

Q43: Converting an annuity to an annuity due

Q56: Some home loans involve "points," which are

Q69: What APR is being earned on a

Q80: How much will accumulate in an account

Q96: A capital investment that generates a 10%