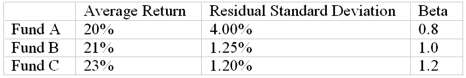

You want to evaluate three mutual funds using the information ratio measure for performance evaluation.The risk-free return during the sample period is 6%, and the average return on the market portfolio is 19%.The average returns, residual standard deviations, and betas for the three funds are given below.  The fund with the highest information ratio measure is

The fund with the highest information ratio measure is

Definitions:

Market To Book Ratio

A ratio used to compare a company's market value (market capitalization) to its book value, providing insight into how the market values the company's equity.

Book Value Per Share

The financial measure that indicates the per-share value of a company's equity available to shareholders, calculated by dividing net assets by the total number of outstanding shares.

Total Market Value

The aggregate valuation of a company, measured by multiplying its current share price by its total outstanding shares.

Cost Of Goods Sold

Costs directly linked to manufacturing goods that a company sells, comprising expenditures on materials and labor.

Q1: Portfolio A consists of 400 shares of

Q14: You sold one wheat future contract at

Q15: A portfolio manager's ranking within a comparison

Q46: In the infrequent foreign marketing stage of

Q51: A firm has an ROA of 14%,

Q54: Discuss the tax status of the major

Q63: _ are boundaries that investors place on

Q73: In a particular year, Razorback Mutual Fund

Q90: An American-style call option with six months

Q92: Which of the following is one of