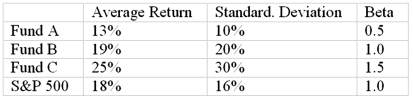

You want to evaluate three mutual funds using the Treynor measure for performance evaluation.The risk-free return during the sample period is 6%.The average returns, standard deviations, and betas for the three funds are given below, in addition to information regarding the S&P 500 Index.  The fund with the highest Treynor measure is

The fund with the highest Treynor measure is

Definitions:

Administrative Law Judge

An official who presides over federal, state, or local administrative hearings and has the authority to make decisions on disputes involving administrative laws.

Subpoena

A document issued by a court ordering someone to appear in court or to produce documents or evidence.

Food And Drug Administration

A federal agency of the United States Department of Health and Human Services responsible for protecting and promoting public health through the control and supervision of food safety, tobacco products, dietary supplements, prescription and over-the-counter pharmaceutical drugs, vaccines, biopharmaceuticals, blood transfusions, medical devices, electromagnetic radiation emitting devices (ERED), cosmetics, animal foods & feed, and veterinary products.

Trade Secrets

Confidential business information that provides a competitive edge, such as formulas, practices, processes, designs, instruments, or patterns.

Q16: Historically, P/E ratios have tended to be<br>A)higher

Q24: A hedge fund attempting to profit from

Q29: The risk profile of hedge funds _,

Q34: Which of the following are commonly thought

Q43: _ refers to sorting through huge amounts

Q46: Fundamental analysis uses<br>A)earnings and dividends prospects.<br>B)relative strength.<br>C)price

Q55: FOX Company has a ratio of (total

Q60: The financial statements of Midwest Tours are

Q73: In a particular year, Razorback Mutual Fund

Q77: The financial statements of Snapit Company are